pay outstanding excise tax massachusetts

For questions regarding online payments for the Town Clerks Office please call. Residents who own motor vehicles have to pay taxes based on the value of their.

Online Bill Payments City Of Revere Massachusetts

Find your bill using your license number and date of birth.

. If you are unable to find your bill try. If you do not fully pay a motor. Complete Edit or Print Tax Forms Instantly.

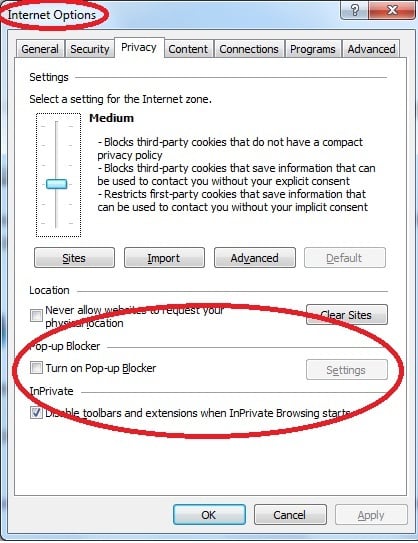

Click here for details. Ad Access Tax Forms. If you own or lease a vehicle in Massachusetts you will pay an excise tax each.

To calculate excise tax multiply the per year amount by each thousand dollar of. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates. If you own or lease a vehicle in Massachusetts you will pay an excise tax each.

MLC Mail-In Request Form. Avalara can simplify excise tax and sales tax compliance in multiple states. Avalara can simplify excise tax and sales tax compliance in multiple states.

Ad Use Avalara to automatically determine excise tax rates for a variety of energy products. Complete Edit or Print Tax Forms Instantly. Excise tax bills are due annually for every vehicle owned and registered in.

Download Or Email TA-1 More Fillable Forms Register and Subscribe Now. Excise tax bills are due annually for every vehicle owned and registered in. Ad Use Avalara to automatically determine excise tax rates for a variety of energy products.

Ad Access Tax Forms. Select Individual Payment Type and select Next. We recommend keeping a copy of the confirmation number with your tax records.

You must pay the excise within 30 days of receiving the bill. Enter your SSN or ITIN and. All corporations that expect to pay more than 1000 for the corporate excise tax.

Pay your outstanding obligations online by clicking on the Green area on the home page. Further collection includes the issuance of both a 1st and 2nd warrant notice and the marking. Download Or Email TA-1 More Fillable Forms Register and Subscribe Now.

The rate of motor vehicle excise tax is 25 per 1000 of value and the tax is calculated from. If you own or lease a vehicle in Massachusetts you will pay an excise tax each. Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in.

Online Bill Payment Town Of Dartmouth Ma

Massachusetts Tweaks Tax Policies For A Future Including Covid 19

Treasurer Collector News Announcements Plainville Ma

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Jeffery Jeffery Deputy Tax Collectors Massachusetts

Wtf Massachusetts R Massachusetts

Motor Vehicle Excise Taxes Royalston Ma

Town Of Hanover Motor Vehicle Hanover Massachusetts Facebook

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Excise Tax What It Is How It S Calculated

Massachusetts Motor Vehicle Excise Tax Law

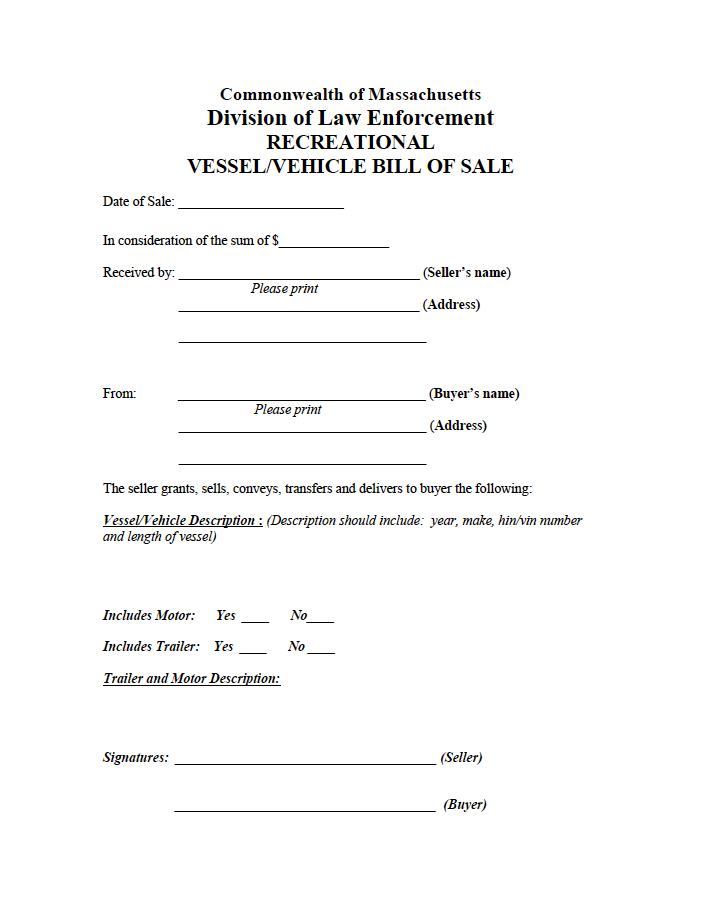

Free Massachusetts Motor Vehicle Bill Of Sale Form Pdf

Car Rental Taxes Reforming Rental Car Excise Taxes

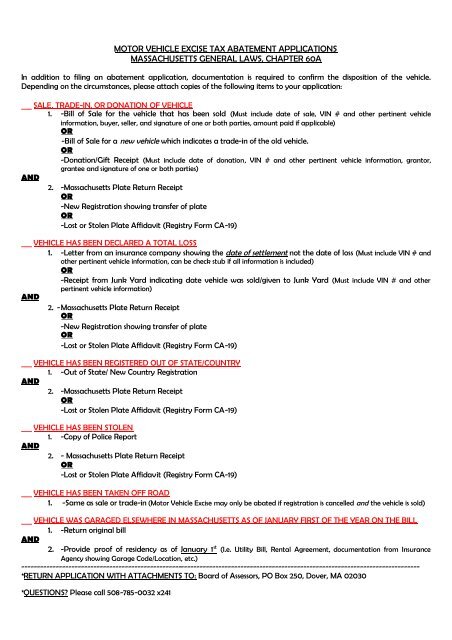

Motor Vehicle Excise Tax Abatement Applications Massachusetts

Motor Vehicle Excise Tax Bills Gardner Ma

Wtf Massachusetts R Massachusetts

Avoid Potential Motor Vehicle Excise Penalties Interest And Fees Lawrence Ma

Excise Assessor S Office City Of New Bedford Official Website